-

Jesse, John & Pickett Street on National Public Radio (NPR)

October 19, 2010 /Last week I was contacted by a reporter from KPLU, the Seattle affiliate for National Public Radio, wondering if I would sit down with her and talk about how many banks have elected to temporarily suspend their foreclosure process. So last Thursday she showed up at our offices, microphone in hand, and we spent the next 90 minutes discussing this brave new world of real estate. 90 minutes of conversation with three different agents (Dennis Pearce, John McCants and myself) was edited down to 4 minutes, and a good share of that was split with Jillayne Schlicke - real estate and mortgage educator extraordinaire, and Richard Hagar - a Seattle real estate appraiser. The piece aired nationally on the "Weekend Edition" on NPR this past Sunday. I think that the initial pitch for the story was an investigative report as to how the suspension of foreclosures from big banks like Bank of America, JP Morgan Chase, and GMAC was effecting the day-to-day operation of real estate businesses like ours. As a real estate team that services short sale, bank-owned, resale, new construction, and auction properties, the suspensions most greatly affected our auction business. John is quoted in the report discussing…Read more

-

All the things short sales are. And those that they are not.

July 28, 2010 /DISCLAIMER: This was initially published as part of an email newsletter to my clients. It made the rounds, and I was asked to post it on the blog to make it more accessible. I wish that there were more short sale jokes - in the same way that there are lawyer jokes, blonde jokes, or jokes about North Dakota. This would mean that there was at least a level of understanding about short sales that was shared among a large group of people. And it would mean that there was something humorous about the process... I've had a couple of painful weeks with short sales. Most real estate agents don't handle short sale transactions because they (1) take a long time (2) pay less money and (3) are frustrating beyond measure. When some of my own clients were faced with the possibility of having to short sale, I decided to educate myself on short sales to ensure that they received the same measure of customer service as my other clients. Negotiating short sales is a lot like navigating a minefield...only it's on a giant treadmill where the environment is constantly changing, and the threat of danger has to be reassessed…Read more

-

Keller Williams & Pickett Street give back: RED Day 2010

June 10, 2010 /Pickett Street Properties Team joined Keller Williams associates across America on May 13th - and took the day off! But it was hardly a day of rest. Over 25,000 associates across the US and Canada spent their day giving back, as part of the company’s community service initiative called RED Day. Short for “Renew, Energize, and Donate,” RED Day was created to unite Keller Williams Realty office and associates in an international day of service. Andy and our team coordinated the activities for our Keller Williams Realty Bothell – and it was an incredible and very rewarding experience. We ended up with 60+ associates and several vendor/partners volunteering, serving in several projects throughout the greater Bothell area: Home Renovation: We scoured our community for a home that needed some work, and approached several owners to see if they’d be interested in our help. It took a while to find someone who would accept our “no strings attached” offer. Once we started working – they were thrilled. The family home we served had not been touched in over 30 years. Our team of volunteers gave it an entire “exterior makeover”, including: complete house scraping, sanding, cleaning, and painting (with colors chosen…Read more

-

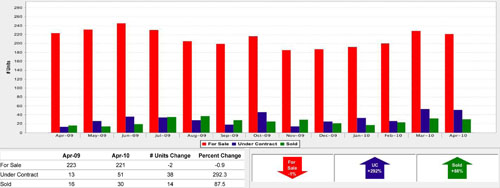

Signs of a stabilizing market? Neighborhood indicators and trends emerge…

May 11, 2010 /There was a time when real estate agents helped people buy and sell homes. Then the market changed, and now we do a lot more counseling, some financial advising, negotiating short sales with banks, and on the flip side - evaluating properties for banks as they liquidate their foreclosed assets. Regarding the latter, banks ask real estate agents to complete BPOs (broker price opinions), to give them an understanding of the local market and an evaluation of the property's value. Banks do not pay agents well for this service, but agents (including myself) do them in the hopes of listing bank-owned properties. When completing BPOs, I have enough experience that if I'm familiar with the neighborhood I have an intuitive idea what the price of the home should be before I go about the work of proving it. My intuition is not enough for the banks though, so I have to complete a fairly rigorous form that goes over statistical averages for the neighborhood of the home that I'm evaluating. I hate BPOs - but the truth is, doing them on a regular basis makes me a better agent. It's easy to take what's true for a majority of neighborhoods…Read more

-

Happy St. Patrick’s Day – from the Irishman of the Pickett Street Team!

March 17, 2010 /St. Patrick’s Day is always a special celebration for me - even though I’m a few generations removed from actually being very Irish. But I do know that my O’Shea family originally came from County Cork and County Kerry in Ireland. I also know that I’ve been saving money so that my wife and I can go tour castles in Ireland on our 20th wedding anniversary! If you decide to experience some authentic Irish celebrations – here are a few local Irish Restaurants and PUBs: Seattle area: Kell’s Irish Restaurant and Pub – Pike Place Market, 1916 Post Alley, 206-728-1916 (come early!) The Dubliner – Fremont, 3405 Fremont Ave N, 206-634-3161 Fado Irish Pub – Downtown, 801 First Ave, 206-264-2700 Paddy Coyne’s – Lake Union Northend: Mick Finster’s Pub & Grill – Edmonds, 24001 Hwy 99, 425-775-2121 Shawn O’Donnell’s Rest. & Pub – South Everett, 122 128th St SE, 425-338-5700 The Irishman – Downtown Everett, 2923 Colby Ave, 425-374-5783 Eastside: JJ Mahoney’s – Redmond, 8932 161st Ave NE, 425-558-1866 Wilde Rover Irish Pub – Kirkland, 111 Central Way, 425-822-8940 Celtic Bayou – Redmond, 7281 Sammamish Pkwy NE, 425-881-0704 (shuttle bus from Marymoor Park every 15 mins from 4pm to 2am)…Read more

-

Pickett Street goes to New Orleans

February 26, 2010 /We recently returned from a business trip to New Orleans (and before everyone asks - no, it wasn't during Mardi Gras!), which was host to the international convention for Keller Williams Realty International. The trip yielded many new ideas and philosophies for our business, but I won't bore you with that right now. Instead, we want to share with you our five favorite things about The Big Easy. 5) Everything but Bourbon Street - We got to our hotel at about 1:00am on Friday night, and while our initial intention was to find a blues club and a glass of wine, I thought our late arrival would surely shelve these plans. One of our friends had arrived earlier, and in waiting for us, had brewed himself a pot of coffee, and there wasn't any way he was going to let us go to bed without a quick walk down Bourbon Street. Our hotel was two blocks from Bourbon Street, so within a couple of minutes we were introduced to New Orlean's most renowned destination. I won't get into everything we saw, smelled, or stepped on, but we all left a little wide-eyed. The street is woven in debauchery, and the…Read more

-

And the winner is…

January 27, 2010 /Pickett Street Properties is proud and honored to announce that all 4 of us just received the “2009 – 5 Star Realtor Award, Best in Client Satisfaction,” recently published in Seattle Magazine. This is a great honor for us - because our greatest desire is to serve our clients incredibly well. Only 758 local Realtors received this award of the over 20,000+ licensed Agents in our area. Here’s how the awards are determined: First, over 22,500 people who recently bought or sold homes were surveyed by mail and phone. Next, professionals in the mortgage and title industry were surveyed for their nominees. Stacks of surveys were received, screened and scored by Crescendo Business Services. Finally, a blue ribbon panel of local industry experts reviewed the finalists list - and the winners were announced! Those surveyed were asked to evaluate their nominees based on nine criteria: Customer service, communication, finding the right home, integrity, negotiation, marketing the home, market knowledge, closing preparation, and closing satisfaction. We want to thank our clients and those we work with for nominating us. We are thrilled with the awards, and will continue to do our best to exceed our clients’ expectations and goals. Several Agents…Read more

-

The cost of waiting

January 13, 2010 /I just listened to a great call with an eye towards what we can expect in the year 2010 in the housing and rate market. A great point was brought up about the cost of waiting. Right now the government has pushed some major incentives into the market. In December of 2008 the government announced a purchasing program that pushed rates roughly 1% lower than where they were the previous month, and had been for almost a year. The Government is also allowing for a TRUE TAX CREDIT of $8000 for first time home buyers that is set to expire in April. These 2 things can make a huge difference for a first time home buyer. If you wait to buy and rates go up the roughly 1% that most experts are forecasting, you would be looking at a cost of about 5% of your loan amount upfront to buy down your mortgage rate back down to current levels, on a $200,000 loan that is $10,000. Add to that the loss of the tax rebate, that is nearly $20,000, or about 10% of the purchase amount. A more impressive number is the lifetime cost of a mortgage that is 1%…Read more

-

Paying the Governor’s Share: Excise Tax & Short Sales

December 23, 2009 /Here in Washington state, we are accustomed to paying an excise/state sales tax when we purchase goods. Interestingly enough, when it comes to the most significant acquisition most of us will make, the seller, rather than the purchaser, covers the taxes. Currently, the base Washington state excise tax rate is 1.28%, with each county adding on their own percentage for a total that fluctuates somewhat by area. Snohomish and King County excise taxes (in most areas) are at a .50 rate, bringing the grand total to 1.78% of the purchase price. An obvious question if you're a distressed home seller would be, "who exactly pays this tax in the event of a short sale?" In most cases, the burden falls to the bank that is carrying the mortgage to ‘eat’ that cost, along with the other costs associated with selling a home. For a brief time at the beginning of 2009, some sellers were required to pay excise tax on the amount of the shortage (the difference between what they owed, and what they were able to sell their property for in a declining market). Sellers in this category may now be eligible for a refund of excise taxes. Use…Read more

-

The anatomy of a short sale

December 17, 2009 /One of the most frustrating forms of a real estate transaction of late is the "short sale." We've had a lot of questions lately about this kind of sale, so I want to address some of the primary questions and myths. 1) A boy named Sue: There are a lot of misconceptions about short sales, starting with their name. A "short sale" is not a denotation of time - short sales actually take a long time to close. A short sale is a real estate transaction where the seller owes more for the property than the property is currently worth. In other words, the seller doesn't have any equity and in order to sell, the bank is going to have to agree to accepting less than what they're owed. For example, John Doe bought a property in 2007 for $380,000. It's now 2010, and the local real estate market has tumbled. In a "choose-your-own-adventure" twist, let's say that John (1) got divorced, (2) lost his job, (3) is transferred out of state, (4) develops a medical condition that forces a move, or (5) simply can't afford his home anymore. John's house is now worth $340,000, and since closing costs for…Read more

-

The New, Improved, (and extended) $8,000 Tax Credit

November 22, 2009 /By now you've probably heard: The $8,000 Tax Credit has been extended! And you're thinking, "I've been wanting to buy a home... maybe there's something to this procrastination thing, after all." In this case, you'd be right; The last go-round provided up to $8,000 to homebuyers who had not owned a home in the past 3 years, and whose income was $75,000 for single taxpayers and $150,000 for married taxpayers filing joint returns. In recognition of your patience and wisdom, you are now eligible for the Sweetened Deal: For home purchases occurring after November 6, 2009, the new income limits are $125,000 for single taxpayers and $225,000 for married couples filing jointly. Be prepared to prove it! Due to the very real potential for fraud, you will be required to prove that you have not owned a home in the last 3 years, however, the credit can be allocated to the person who has not owned previously, in cases where parents are assisting with a purchase, or where one member of an unmarried couple has previously owned. Saving for a downpayment? Another element of the new version is that it allows prospective home buyers who believe they qualify for the…Read more

-

Green Homes- Fad, Trend, or Future?

November 5, 2009 /Among the many contentious issues of our day, the concept of being 'environmentally conscious', certainly strikes a few hot buttons for some. This post isn't going to explore the politics of Al Gore, or Rush Limbaugh, because, controversial as that subject may be, there's just not enough space to do the topic justice, and frankly, I don't find it that interesting. My personal angle on the Green Movement tends to slant more toward the practicalities of implementation, and looking at the cost/benefit balance for long term value. Given the condition of our current economy, and the impact of rising energy prices, and prices overall, I don't think it's an overstatement to say everybody's looking for ways to save money. From that perspective, the question becomes one of whether it's more practical to save money now (which frequently means either making do with less, or doing nothing), or to take the preventive and holistic steps that provide for long term cost and resource savings through conservation, thoughtful design, and practical implementation of new home-building technologies. The Green Movement is really just a convenient handle for the overarching conversation that revolves around the management and distribution of resources within a given community, and attempts to…Read more