-

How I lost my roommates

December 12, 2010 /Trevor is my brother-in-law. I've been helping him and his wife to find their first home over the last couple of months. We made an offer on a bank-owned home in Edmonds that was accepted, but in a long and twisted tale of banking regulation gone wrong, they had to give up that home and start their search over again. They also had to move - they had given notice at their apartment complex and their unit had already been rented out. So that's how I gained two roommates :) Trevor and Liz were originally hesitant to consider properties sold at trustee's sale, but being forced to live with me encouraged them to look at all options. After watching a few properties that would normally be outside of their price range sell well within their range, Trevor and Liz threw themselves into the process. They were pre-approved to borrow funds at auction, received a username and password to search our trustee sale database, and started driving properties that they were interested in. Trevor bid on a home at auction every week for three weeks prior to Thanksgiving, barely losing out on all three. He was being conservative at my insistance…Read more

-

Pickett Street investor purchases at trustee’s sale

November 19, 2010 /Last Friday, new investor Ron Wong purchased his first investment property at a steep discount (67%) in South Everett. The home was a very well cared for 1955 built rambler on a great street and large lot with a detached garage. Ron met the owner earlier in the week with me (John McCants) and toured the house. The owner had been trying to work with one of the largest banks in America on a modified payment plan for over two years with no success. He was unable to afford the repairs the house and the house ultimately went to trustee sale (auction) and sold to our investor. The property needed a new roof, some landscaping, and touch-up on the inside to hardwood floors and paint. The home has two remodeled bathrooms and a new kitchen. It is very unfortunate for the previous homeowner that he could not keep his home, but to Ron, it was a opportunity to do what he has dreamed about for years: build his wealth by buying real estate at wholesale. Ron plans to complete the work in the next few weeks as the previous homeowner moves out and re-list the property with the Pickett Street…Read more

-

Knock, knock: Gaining access to a home going to auction

November 10, 2010 /I was in the field yesterday driving a few "Hot Properties" with a investor client. We were driving the list of properties with bids we had and few that looked hot based on their location and debt amount that did not have specific opening bids. We found a couple homes that were not so hot and marked them accordingly to update our website, but we found a couple properties with valley views of the Snohomish River and one overlooking Puget Sound and views of the Olympic Mountains that were wholesale values prime for auction purchasing. At one property in a really good neighborhood of Everett we found a nice home occupied by the owner. The homeowner toured the house for us and explained in detail all he had done to update the property and what was wrong still needed updating. We asked why he hadn't worked out the situation with the Bank and he said he had been trying for over 2 years with no success. We discussed that issue for a few minutes and left the home with the owners contact info for use later. After leaving the home my investor stated "that was a great house and great…Read more

-

Buying a home at trustee’s sale in Washington State

November 9, 2010 /Remember 2006? When there were basically only two types of real estate to buy - resale or new construction? Most people, including real estate agents, hadn't even heard of short sales, and bank-owned properties made up such a small percentage of the market that finding one was a little like hunting a rainbow. It's a different time, and our team has done our best to diversify. It started by educating ourselves on the short sale process, extended into representing local and national banks on marketing their foreclosures, and in the last six months we've developing an effective system of representing buyers purchasing properties at trustee's sale in King and Snohomish Counties. What is a Trustee's Sale? Sometimes generically referred to as auction, county auction, sheriff's sale, or foreclosure auction, trustee's sales are the natural process in our state for foreclosing on a home. There are two types of foreclosures in our country, either judicial or non-judicial. Judicial foreclosures require banks to go through the court system to foreclose on a property - non-judicial foreclosures, like those in Washington State - don't go through the court system, but instead follow a set of established laws and notices that eventually lead to…Read more

-

Jesse, John & Pickett Street on National Public Radio (NPR)

October 19, 2010 /Last week I was contacted by a reporter from KPLU, the Seattle affiliate for National Public Radio, wondering if I would sit down with her and talk about how many banks have elected to temporarily suspend their foreclosure process. So last Thursday she showed up at our offices, microphone in hand, and we spent the next 90 minutes discussing this brave new world of real estate. 90 minutes of conversation with three different agents (Dennis Pearce, John McCants and myself) was edited down to 4 minutes, and a good share of that was split with Jillayne Schlicke - real estate and mortgage educator extraordinaire, and Richard Hagar - a Seattle real estate appraiser. The piece aired nationally on the "Weekend Edition" on NPR this past Sunday. I think that the initial pitch for the story was an investigative report as to how the suspension of foreclosures from big banks like Bank of America, JP Morgan Chase, and GMAC was effecting the day-to-day operation of real estate businesses like ours. As a real estate team that services short sale, bank-owned, resale, new construction, and auction properties, the suspensions most greatly affected our auction business. John is quoted in the report discussing…Read more

-

All the things short sales are. And those that they are not.

July 28, 2010 /DISCLAIMER: This was initially published as part of an email newsletter to my clients. It made the rounds, and I was asked to post it on the blog to make it more accessible. I wish that there were more short sale jokes - in the same way that there are lawyer jokes, blonde jokes, or jokes about North Dakota. This would mean that there was at least a level of understanding about short sales that was shared among a large group of people. And it would mean that there was something humorous about the process... I've had a couple of painful weeks with short sales. Most real estate agents don't handle short sale transactions because they (1) take a long time (2) pay less money and (3) are frustrating beyond measure. When some of my own clients were faced with the possibility of having to short sale, I decided to educate myself on short sales to ensure that they received the same measure of customer service as my other clients. Negotiating short sales is a lot like navigating a minefield...only it's on a giant treadmill where the environment is constantly changing, and the threat of danger has to be reassessed…Read more

-

Keller Williams & Pickett Street give back: RED Day 2010

June 10, 2010 /Pickett Street Properties Team joined Keller Williams associates across America on May 13th - and took the day off! But it was hardly a day of rest. Over 25,000 associates across the US and Canada spent their day giving back, as part of the company’s community service initiative called RED Day. Short for “Renew, Energize, and Donate,” RED Day was created to unite Keller Williams Realty office and associates in an international day of service. Andy and our team coordinated the activities for our Keller Williams Realty Bothell – and it was an incredible and very rewarding experience. We ended up with 60+ associates and several vendor/partners volunteering, serving in several projects throughout the greater Bothell area: Home Renovation: We scoured our community for a home that needed some work, and approached several owners to see if they’d be interested in our help. It took a while to find someone who would accept our “no strings attached” offer. Once we started working – they were thrilled. The family home we served had not been touched in over 30 years. Our team of volunteers gave it an entire “exterior makeover”, including: complete house scraping, sanding, cleaning, and painting (with colors chosen…Read more

-

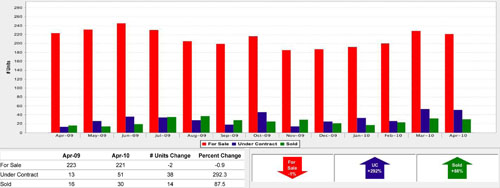

Signs of a stabilizing market? Neighborhood indicators and trends emerge…

May 11, 2010 /There was a time when real estate agents helped people buy and sell homes. Then the market changed, and now we do a lot more counseling, some financial advising, negotiating short sales with banks, and on the flip side - evaluating properties for banks as they liquidate their foreclosed assets. Regarding the latter, banks ask real estate agents to complete BPOs (broker price opinions), to give them an understanding of the local market and an evaluation of the property's value. Banks do not pay agents well for this service, but agents (including myself) do them in the hopes of listing bank-owned properties. When completing BPOs, I have enough experience that if I'm familiar with the neighborhood I have an intuitive idea what the price of the home should be before I go about the work of proving it. My intuition is not enough for the banks though, so I have to complete a fairly rigorous form that goes over statistical averages for the neighborhood of the home that I'm evaluating. I hate BPOs - but the truth is, doing them on a regular basis makes me a better agent. It's easy to take what's true for a majority of neighborhoods…Read more

-

Happy St. Patrick’s Day – from the Irishman of the Pickett Street Team!

March 17, 2010 /St. Patrick’s Day is always a special celebration for me - even though I’m a few generations removed from actually being very Irish. But I do know that my O’Shea family originally came from County Cork and County Kerry in Ireland. I also know that I’ve been saving money so that my wife and I can go tour castles in Ireland on our 20th wedding anniversary! If you decide to experience some authentic Irish celebrations – here are a few local Irish Restaurants and PUBs: Seattle area: Kell’s Irish Restaurant and Pub – Pike Place Market, 1916 Post Alley, 206-728-1916 (come early!) The Dubliner – Fremont, 3405 Fremont Ave N, 206-634-3161 Fado Irish Pub – Downtown, 801 First Ave, 206-264-2700 Paddy Coyne’s – Lake Union Northend: Mick Finster’s Pub & Grill – Edmonds, 24001 Hwy 99, 425-775-2121 Shawn O’Donnell’s Rest. & Pub – South Everett, 122 128th St SE, 425-338-5700 The Irishman – Downtown Everett, 2923 Colby Ave, 425-374-5783 Eastside: JJ Mahoney’s – Redmond, 8932 161st Ave NE, 425-558-1866 Wilde Rover Irish Pub – Kirkland, 111 Central Way, 425-822-8940 Celtic Bayou – Redmond, 7281 Sammamish Pkwy NE, 425-881-0704 (shuttle bus from Marymoor Park every 15 mins from 4pm to 2am)…Read more

-

Pickett Street goes to New Orleans

February 26, 2010 /We recently returned from a business trip to New Orleans (and before everyone asks - no, it wasn't during Mardi Gras!), which was host to the international convention for Keller Williams Realty International. The trip yielded many new ideas and philosophies for our business, but I won't bore you with that right now. Instead, we want to share with you our five favorite things about The Big Easy. 5) Everything but Bourbon Street - We got to our hotel at about 1:00am on Friday night, and while our initial intention was to find a blues club and a glass of wine, I thought our late arrival would surely shelve these plans. One of our friends had arrived earlier, and in waiting for us, had brewed himself a pot of coffee, and there wasn't any way he was going to let us go to bed without a quick walk down Bourbon Street. Our hotel was two blocks from Bourbon Street, so within a couple of minutes we were introduced to New Orlean's most renowned destination. I won't get into everything we saw, smelled, or stepped on, but we all left a little wide-eyed. The street is woven in debauchery, and the…Read more

-

And the winner is…

January 27, 2010 /Pickett Street Properties is proud and honored to announce that all 4 of us just received the “2009 – 5 Star Realtor Award, Best in Client Satisfaction,” recently published in Seattle Magazine. This is a great honor for us - because our greatest desire is to serve our clients incredibly well. Only 758 local Realtors received this award of the over 20,000+ licensed Agents in our area. Here’s how the awards are determined: First, over 22,500 people who recently bought or sold homes were surveyed by mail and phone. Next, professionals in the mortgage and title industry were surveyed for their nominees. Stacks of surveys were received, screened and scored by Crescendo Business Services. Finally, a blue ribbon panel of local industry experts reviewed the finalists list - and the winners were announced! Those surveyed were asked to evaluate their nominees based on nine criteria: Customer service, communication, finding the right home, integrity, negotiation, marketing the home, market knowledge, closing preparation, and closing satisfaction. We want to thank our clients and those we work with for nominating us. We are thrilled with the awards, and will continue to do our best to exceed our clients’ expectations and goals. Several Agents…Read more

-

The cost of waiting

January 13, 2010 /I just listened to a great call with an eye towards what we can expect in the year 2010 in the housing and rate market. A great point was brought up about the cost of waiting. Right now the government has pushed some major incentives into the market. In December of 2008 the government announced a purchasing program that pushed rates roughly 1% lower than where they were the previous month, and had been for almost a year. The Government is also allowing for a TRUE TAX CREDIT of $8000 for first time home buyers that is set to expire in April. These 2 things can make a huge difference for a first time home buyer. If you wait to buy and rates go up the roughly 1% that most experts are forecasting, you would be looking at a cost of about 5% of your loan amount upfront to buy down your mortgage rate back down to current levels, on a $200,000 loan that is $10,000. Add to that the loss of the tax rebate, that is nearly $20,000, or about 10% of the purchase amount. A more impressive number is the lifetime cost of a mortgage that is 1%…Read more