If you’ve been keeping up with recent economic events, you’re probably aware that the Fed has chosen to keep interest rates stable, rather than moving forward with the raise that many experts anticipated. While the American dollar has strengthened, and while unemployment rates have improved more quickly than originally expected (it currently sits at a lean 5.1%), the Fed still decided to take a cautious approach. The Fed has cited a few factors, most notably a weak global market, for its decreased confidence in predictions for inflation.

The Fed considers the global economy to be weak for a couple of reasons. The prices of commodities have decreased, and a relatively robust American economy has lowered the price of imported goods. Additionally, while the domestic economy shows encouraging signs of continued improvement, there are still a few worrying trends; many employed citizens, for instance, only work part-time and are still searching for more lucrative, full-time employment. Additionally, the rate of inflation still lies below the Fed’s desired 2%, the ideal rate of inflation for a healthy economy. In the face of a less than ideal global economy, the job market is going to need to strengthen, and the inflation rate must show more promising signs of reaching 2%, before the Fed is willing to raise interest rates.

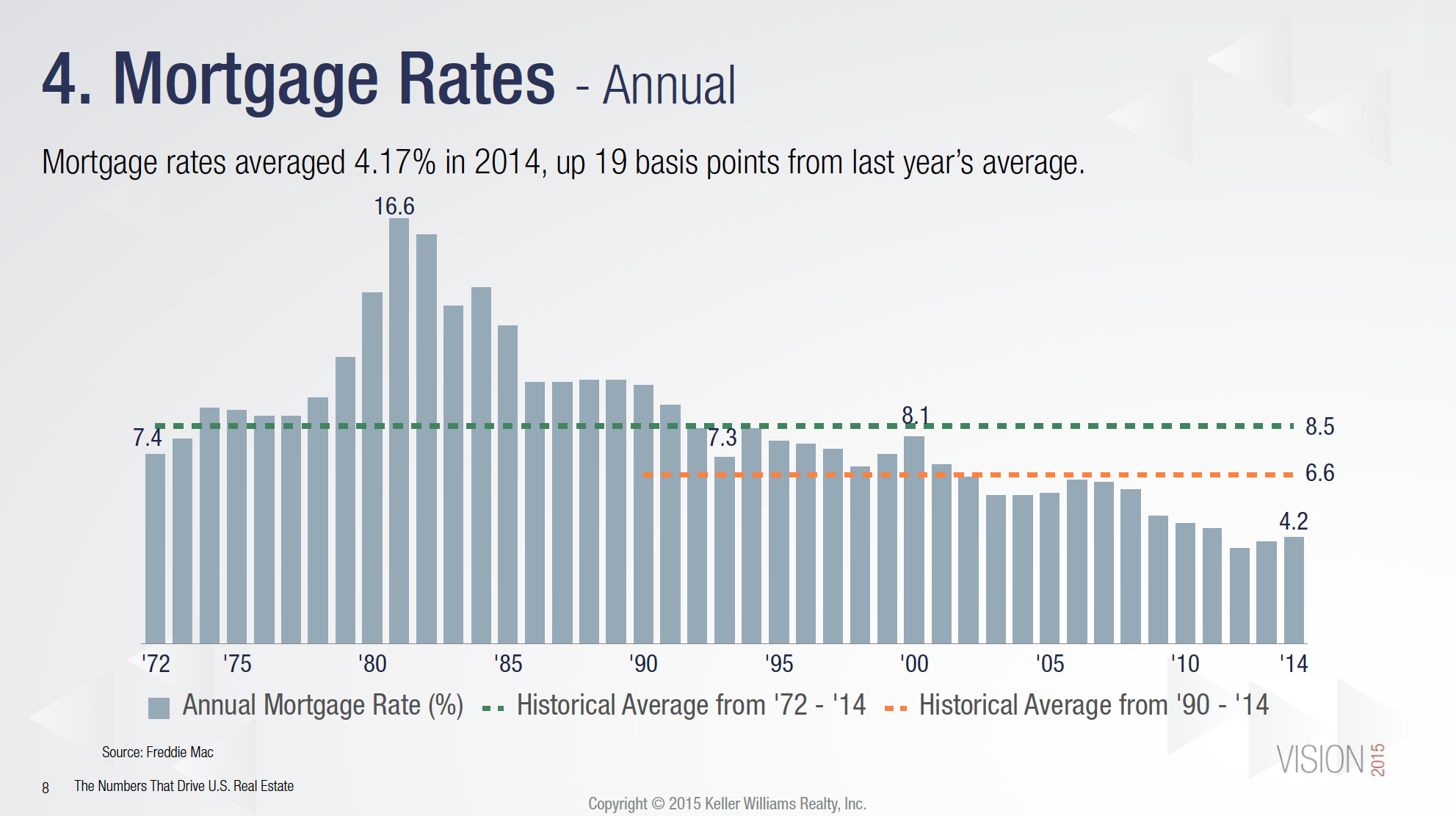

However, while the Fed might be wary of the current global market, its decision not to raise interest rates has some beneficial implications for mortgages. With low rates of inflation come low mortgage rates, so as long as the Fed maintains low rates of interest, it’s likely that mortgage rates with remain correspondingly low. At this point, the average national rate for a 30 year Fixed Rate Mortgage is currently at about 3.9%, down from last year’s already low 4.2% average. Even better, if the Fed does decide to raise rates in later on in the year, the increase is likely to be modest, rather than dramatic. This trend suggests that the outlook for affordability, which measures the average ease with which a typical family is able to secure a mortgage loan, is promising.

In short, the Fed’s recent decision means that, for now, mortgage rates will stay low. More importantly, it’s unlikely that mortgage rates will skyrocket any time soon, even if the Fed does impose increases. In that case, it’s a good time to be in the market for a home. Adjustable Rate Mortgages, of course, are always subject to change and are never guaranteed to stay at any particular rate. If, however, you’re looking for a Fixed Rate Mortgage, which is guaranteed to stay at the same rate, it’s a great time to seal the deal. If you’re a homeowner applying for a 30 year Fixed Rate Mortgage, it’s a great time to capitalize on low rates and finalize a sound financial decision that you’ll be thankful for when rates rise again in the future.