Question: Is it still possible to get a zero down payment home loan?

Answer: For the month of September, yes. (Now extended through the end of December).

I received a phone call on Monday – a request from a young couple wanting to walk through a few of the floorplans available at the Summit View plat in Bothell. As we walked through the homes I asked the common questions – making sure that they were aware of the $8,000 tax credit, and it’s looming expiration date. They were. I asked if they were aware of the special financing available on these brand new homes, including zero down payment and a 3.875% interest rate if they made an offer in September. They were. In fact, they were way ahead of me…

She is a grad student, an unpaid intern on her way to a stable and well-paying vocation. He is self-employed, has been for five years. They have two kids in elementary school, so getting into an award-winning school district was important to them. If they would have tried to buy three years ago there wouldn’t have been a problem. “Stated income” loans existed then – a now extinct type of loan that allowed those that were self-employed to pretty much state their income with little verification to secure a loan. These loans were necessary because most people that are self-employed write off a large portion of their income for tax purposes – which means that they might be able to afford quite a bit in reality, but on paper they don’t make much of anything. This put a lot of faith in the person stating their income – if they liked the home enough they might decide to overstate their income. Then the economy stumbles, right around the same time that their rate adjusts, and suddenly “stated income” loans have a high rate of failure. As a result, stated income loans go bye-bye.

So the young couple puts off their home search. But as the market tumbles, they continue to keep their eyes open. Eventually home sales start to rise, the government offers an $8,000 incentive to home buyers, and the young couple talks to a mortgage broker. The mortgage broker approves them for $325,000, but for a family of four used to living in a large home in Queen Anne, this doesn’t buy much.

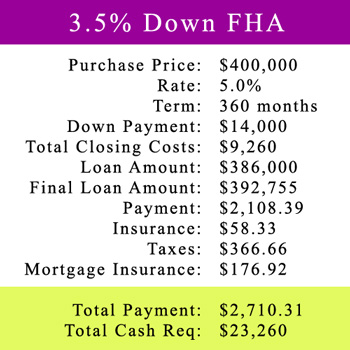

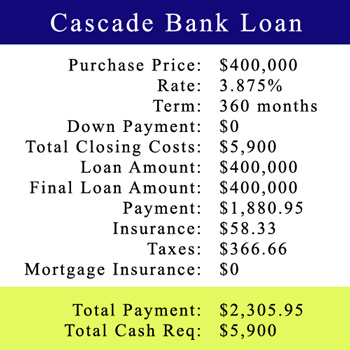

Eventually they come across Summit View, a new home community in Bothell built by Calibre Homes. These homes are NOT in their price range, priced from $385,000 – $440,000 for floorplans from 1,750 – 3,013 square feet. But the builder is offering special financing through Cascade Bank: including an interest rate of 3.875%, zero down payment, and no mortgage insurance. They aren’t actuaries, but all of sudden they start to think that $300,000 through conventional means might be more like $400,000 with special financing. So we meet, I go over the numbers, and sure enough, for the same payment as a $325,000 home they can afford to buy a $400,000 house at Summit View. I’ll get to how these numbers work out, but let’s take a look how these two loans stack up side by side:

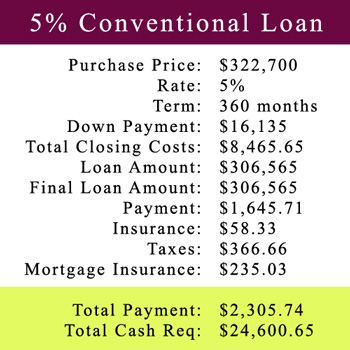

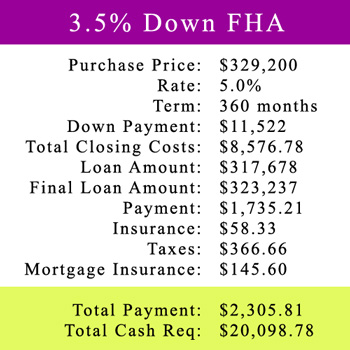

FHA loans are the most popular right now, because they require less down payment. As the comparison above illustrates, an FHA loan is going to cost over $400 more a month, and it’s going to take $17,360 more out of the buyer’s pocket. So here’s the real question: if you can buy a $400,000 home through Cascade Bank for $2,305.95/month – what can you buy with Conventional or FHA financing and get the same monthly payment?

In the end, this young couple had a feeling that the special financing being offered could mean the difference between a $325,000 home and a $400,000 home. Truth is, when you factor in the cash-out-of-pocket difference as well, the difference between a 5% down Conventional loan and the financing being offered at Cascade Bank, it’s a difference of $96,000 ($77,300 more buying power + $18,7000 more cash due to no down payment and lower closing costs). Not only do they get to buy a new $400,000 home at the same payment as a $325,000 home, but they get to keep over $18,000 of cash in their reserves.

So, if you’re wondering, there are zero down loans available. There are very few of them available, but through the month of September, you can find them at the homes at Summit View in Bothell. If you qualify for $300,000, or $325,000, or $350,000 – wouldn’t you want to keep more cash in your bank account and buy a bigger, newer home for the same payment?

Makes sense to me, and at least one other enterprising young couple…

UPDATE: Zero-Down financing has been extended through the month of December and also applies to the homes at Wandering Creek and Inglemoor Crest in Kenmore. Please contact us for more information.