Pricing a home for market: it very well might be the single most important element of a successful home sale, and probably the very reason most sellers should think twice before attempting to sell their home themselves.

I say this as a Realtor and a home owner. No one knows better than myself the sweat and coin that I poured into my home, which my wife and I bought as a foreclosure. We had to rehab the septic system, replace the windows (all 15 of them), hang cellular blinds throughout, replace the attic insulation, sheet and replace the roof, update the kitchen, paint the exterior…well, you get the idea. Knowinig how much time and expense we put into our home, and staying aware of the neghborhood values and the lack of updates in many of those homes, it’s easy for me as a home owner to assume that our home would warrant at least 6-8% more than the market average. As a Realtor, my experience tells me that I’m not objective, and my lack of objectivity might cost me money in the long run.

What do I mean? Citing a collegiate study of the real estate market in California, an article published in Forbes magazine references a couple of statistics that prove a concept that’s counter-intuitive to most sellers: list your home for too much, and it could cost you more money than if you had listed it for less to begin with.

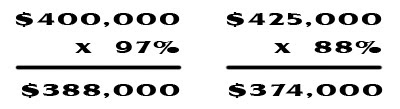

A mispriced home sits on the market longer, and eventually sells for less than a similar, correctly priced home. So found John R. Knight, a professor at University of the Pacific. In his 2002 study, “Listing Price, Time on Market, and Ultimate Selling Price,” he examined 3,490 Stockton, Calif., homes and found that sellers who didn’t reduce their prices sold for 97% of the initial list price. Homes with a price reduction sold for 88% of initial list price.

Let’s break this down to brass tacks: let’s imagine a home that is priced in-line with the market at $400,000 (assuming exhaustive work on behalf of the real estate agent using comparables in the neighborhood). Let’s then say that a comparable neighboring home goes on the market for $425,000, or 6.25% higher (in my experience a scenario not unlike this one isn’t uncommon at all).

As you can see in the image above, based on the statistics derived from the University of Pacific’s study, the over-priced home sells for less money. Over-pricing a home leads to more days on market, more days on market leads to less traffic, less traffic leads to lower prices and even lower offers. There are few things as difficult as explaining this to a seller with unrealistic expectations, but citing a college professor doesn’t hurt!

Our own experiences support these ideas. If you’re thinking of selling, regardless of whether or not you want a “quick” sale, think long and hard before pricing your home above the market averages in your neighborhood. Oh – and call a Pickett Street team member and we’ll make it that much easier for you! 🙂