The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming

By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You’ll want to consult with a mortgage specialist (or two) to find a professional who you are confident will provide you with the best care. To get an idea of what to expect, review the following home loan process steps.

Step One:

Get pre-approval

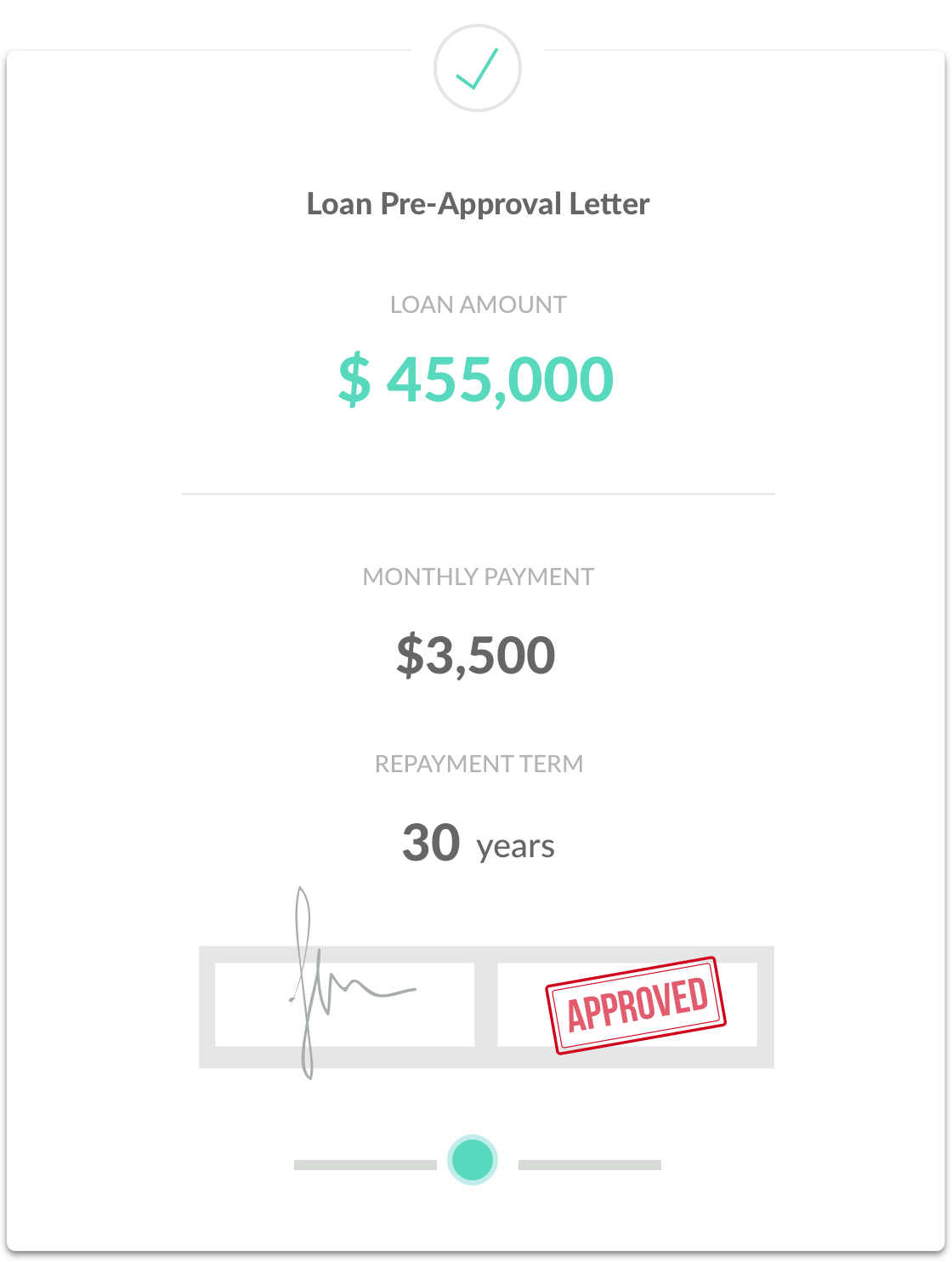

Before you start looking for a home to buy, it’s wise and proactive to meet with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially when the seller is receiving multiple offers.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

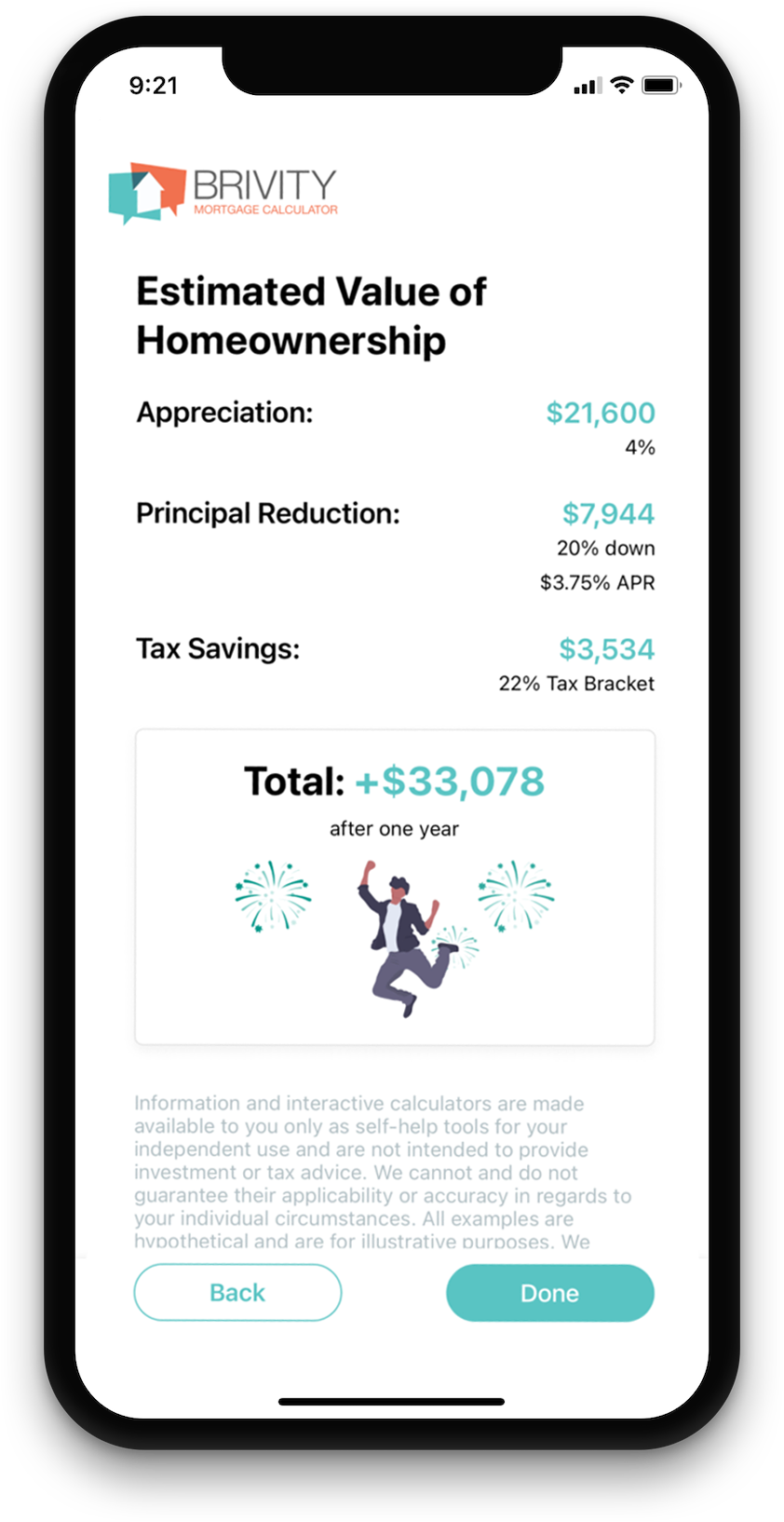

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Application and Processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and Finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!

The database information herein is provided from and copyrighted by the Northwest Multiple Listing Service (NWMLS). NWMLS data may not be reproduced or redistributed and is only for people viewing this site. All information provided is deemed reliable but is not guaranteed and should be independently verified. All properties are subject to prior sale or withdrawal. All rights are reserved by copyright. Property locations as displayed on any map are best approximations only and exact locations should be independently verified. The three tree icon represents listings courtesy of NWMLS.

Based on information submitted to the MLS GRID as of the date listed below. All data is obtained from various sources and may not have been verified by broker or MLS GRID. Supplied Open House Information is subject to change without notice. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

Data last updated: ,

©2025 Northwest Multiple Listing Service

2025 © Jesse D. Moore| Keller Williams Greater Seattle

Each office is independently owned and operated.

Each office is independently owned and operated.

The three tree icon represents listings courtesy of NWMLS.

The three tree icon represents listings courtesy of NWMLS.