-

Neighborhood Profile: Mill Creek

March 8, 2016 /Imagine living in a planned community clustered around a golf course, interspersed with countless miles of hiking trails, and supported by a thriving commercial center. In Mill Creek, all of these characteristics come together to create a truly cozy community. Part of Snohomish County, Mill Creek is located east of Lynnwood, north of Bothell, and just 20 miles away from downtown Seattle. Originally a planned community built around the Mill Creek Country Club and Golf Course, Mill Creek has grown into a tidy and prosperous community stocked to the brim with handsome real estate. Mill Creek’s neighborhood plans make it particularly attractive to residents. Blessed with larger than average lot sizes, and plenty of green space and parks (including sports courts, ball fields, and nearly 25 miles of walking trails), Mill Creek’s neighborhoods are not just places to crash after a long day at work; instead, they’re carefully planned to be enjoyable living spaces that enrich the lives of both children and adults. Some of Mill Creek’s most popular parks include Cougar Park, Heron Park, Highlands Park, Mill Creek Sports Park, and Nickel Creek Park. Last but not least, there is, of course, the original golf course the community was…Read more

-

Don’t Pay Off Your Mortgage!

February 26, 2016 /At least, don’t pay it off quite yet. If you’re an average, hard-working adult with a family and a home to call your own, then chances are you’re probably trying to pay off your mortgage as quickly as possible. This strategy seems pretty sound at first; after all, won’t you save money in the long run by paying off your mortgage ASAP? Surprisingly, in many cases paying off your mortgage quickly won’t save you money at all; indeed, rushing through a mortgage could actually be costing you money in the long run. While you’ll want to pay your mortgage off eventually, it is generally more beneficial to take your time and invest your hard-earned money in other ventures. If this idea seems counterintuitive to you, never fear! Below, you’ll find a few of the main arguments for taking your mortgage payments nice and slow. Your mortgage's interest is tax-deductible. While many people regard paying interest with dread, remember that paying interest on a mortgage will actually reduce the amount of money you need to pay for taxes each year. For instance, say you’re in the 35% tax bracket. Since your interest payments on your mortgage are tax deductible, you’re actually saving…Read more

-

Auction opportunity: Ranch or equestrian property in Snohomish

March 20, 2011 /Every week over 150 properties are scheduled to go to auction (trustee's sale) in Snohomish County. On Friday, March 25th, a property in rural Snohomish is scheduled to sell on the courthouse steps, and it represents a great opportunity for anyone wanting acreage or equestrian property for under $275,000. The structure is a daylight rambler with over 3,400 square feet of living space, with 4 bedrooms and 2.5 bathrooms. The home needs a little TLC, but the real appeal of the property is the 15 acre lot. For those looking for equestrian or even small ranch potential, this is a unique opportunity to buy horse property wholesale. We have investors that will loan cash to qualified buyers on the day of the auction, and even a resource to start an automatic refinance into a contemporary home loan after you purchase the property. The property is occupied, and we want to be sensitive to the situation that the owner is facing, so we're only making further information available to those that schedule a personal consultation to go over the details. If you're interested in learning more about this property or taking advantage of opportunities similar to this, please fill out the…Read more

-

How I lost my roommates

December 12, 2010 /Trevor is my brother-in-law. I've been helping him and his wife to find their first home over the last couple of months. We made an offer on a bank-owned home in Edmonds that was accepted, but in a long and twisted tale of banking regulation gone wrong, they had to give up that home and start their search over again. They also had to move - they had given notice at their apartment complex and their unit had already been rented out. So that's how I gained two roommates :) Trevor and Liz were originally hesitant to consider properties sold at trustee's sale, but being forced to live with me encouraged them to look at all options. After watching a few properties that would normally be outside of their price range sell well within their range, Trevor and Liz threw themselves into the process. They were pre-approved to borrow funds at auction, received a username and password to search our trustee sale database, and started driving properties that they were interested in. Trevor bid on a home at auction every week for three weeks prior to Thanksgiving, barely losing out on all three. He was being conservative at my insistance…Read more

-

Pickett Street investor purchases at trustee’s sale

November 19, 2010 /Last Friday, new investor Ron Wong purchased his first investment property at a steep discount (67%) in South Everett. The home was a very well cared for 1955 built rambler on a great street and large lot with a detached garage. Ron met the owner earlier in the week with me (John McCants) and toured the house. The owner had been trying to work with one of the largest banks in America on a modified payment plan for over two years with no success. He was unable to afford the repairs the house and the house ultimately went to trustee sale (auction) and sold to our investor. The property needed a new roof, some landscaping, and touch-up on the inside to hardwood floors and paint. The home has two remodeled bathrooms and a new kitchen. It is very unfortunate for the previous homeowner that he could not keep his home, but to Ron, it was a opportunity to do what he has dreamed about for years: build his wealth by buying real estate at wholesale. Ron plans to complete the work in the next few weeks as the previous homeowner moves out and re-list the property with the Pickett Street…Read more

-

Knock, knock: Gaining access to a home going to auction

November 10, 2010 /I was in the field yesterday driving a few "Hot Properties" with a investor client. We were driving the list of properties with bids we had and few that looked hot based on their location and debt amount that did not have specific opening bids. We found a couple homes that were not so hot and marked them accordingly to update our website, but we found a couple properties with valley views of the Snohomish River and one overlooking Puget Sound and views of the Olympic Mountains that were wholesale values prime for auction purchasing. At one property in a really good neighborhood of Everett we found a nice home occupied by the owner. The homeowner toured the house for us and explained in detail all he had done to update the property and what was wrong still needed updating. We asked why he hadn't worked out the situation with the Bank and he said he had been trying for over 2 years with no success. We discussed that issue for a few minutes and left the home with the owners contact info for use later. After leaving the home my investor stated "that was a great house and great…Read more

-

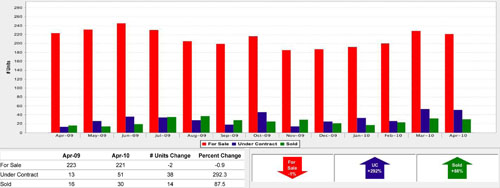

Signs of a stabilizing market? Neighborhood indicators and trends emerge…

May 11, 2010 /There was a time when real estate agents helped people buy and sell homes. Then the market changed, and now we do a lot more counseling, some financial advising, negotiating short sales with banks, and on the flip side - evaluating properties for banks as they liquidate their foreclosed assets. Regarding the latter, banks ask real estate agents to complete BPOs (broker price opinions), to give them an understanding of the local market and an evaluation of the property's value. Banks do not pay agents well for this service, but agents (including myself) do them in the hopes of listing bank-owned properties. When completing BPOs, I have enough experience that if I'm familiar with the neighborhood I have an intuitive idea what the price of the home should be before I go about the work of proving it. My intuition is not enough for the banks though, so I have to complete a fairly rigorous form that goes over statistical averages for the neighborhood of the home that I'm evaluating. I hate BPOs - but the truth is, doing them on a regular basis makes me a better agent. It's easy to take what's true for a majority of neighborhoods…Read more