-

The Monroe Equestrian Property

October 16, 2015 /If you’re a native of Washington State and the Puget Sound, you’ve probably got a few cherished memories from your youth: black coffee on cold winter mornings, the sound of rain pattering on the roof, crackling wood stoves, waves of mist rolling over a sea of pine trees at dusk. While such memories are wonderful, it’s likely that the myriad responsibilities of the adult world have pushed them back into the recesses of your brain. Setting foot on the Monroe Equestrian property, however, allows the once-forgotten sounds, smells, and sights of a Washington childhood to once again flood back into the present. Hidden in a lush undergrowth of pine forest, and commanding a view of five immaculate acres, the Monroe Equestrian property is the classic custom Washington home. The house’s rustic wood paneling mimics the stately trees clustered around it and, while the dense foliage creates a sense of protection and security, expansive and wandering lawns give the property plenty of breathing space. A gazebo affixed to the rear of the house overlooks the backyard, making it the perfect retreat for those fond of autumn mornings, bold coffee, and rustling newspapers. The true charm of the property, however,…Read more

-

Preparing Your Home For Sale

October 2, 2015 /So: you’re preparing to sell your home, and you’re unsure how to start getting everything ready. Even if you’ve taken good care of your home, preparing for a sale can be daunting. That said, a few small, simple improvements will go a long way toward preparing your home for the market, so don’t feel like the prep process is some kind of Goliath you have to slay. Instead, take a look at some of these tips and get rid of all your pre-sale worries... Perfect the Art of Pricing While you may be tempted to launch yourself into physically sprucing up your home, it’s also important to price it properly. A lead listing agent at Pickett Street only works with sellers, so working with Pickett Street will ensure that you receive individualized attention — and therefore better service than you would working with a conventional agent. Since about 90% of homebuyers search for homes via online real estate engines. Pickett Street uses this statistic to help you strategically list your home online using increments of $25,000 in order to maximize the potential buyers reached. Here’s how it works: if your home is worth roughly $500,000, most conventional agents would list…Read more

-

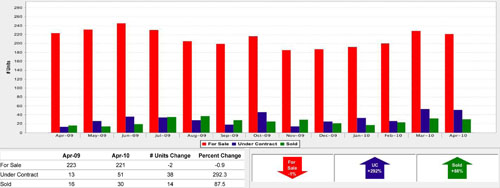

For everything there is a season – a market update from Pickett Street

April 15, 2013 /Happy Tax Day! I never feel like the prior year is over until today, which can make the first three and a half months a little like purgatory. Now that we've graduated fully into 2013, I feel like it's a good time to give you an update on how the real estate market is moving, and how our team, Pickett Street Properties, is changing with the market. It shouldn't be news that the real estate market has changed. After 5 years of depreciation, after 5 years of foreclosures and short sales, our local real estate market is rebounding, and in an aggressive way. Buyers shopping now are paying 15% more than last year in King and Snohomish Counties (year-over-year), and this upward trend in appreciation appears to have some legs. Simply put, demand is up and supply is down. The data can be confusing though. At first glance, housing sales are actually lower in both counties. Knowing that fewer homes are selling should usually worry sellers, but a closer look at the stats shows a different story. There are fewer homes available this year over last year (down over 4% in Snohomish County), fewer homes going under contract compared to…Read more

-

Rising rental market good indication for housing market in the Puget Sound

May 19, 2011 /Two articles published this week indicate that after four years of a struggling real estate market, perhaps things are on the rebound in the Puget Sound. An article entitled "Expect 'new highs' for Seattle apartment rents" published in the Puget Sound Business Journal on May 13th states that the generation of new jobs, slow new construction starts, and low vacancy rates could push rental rates up almost 4% this year. This sentiment is echoed a similar article entitled "Renters finding landlords have upper hand in this market" published by The Seattle Times on the same day. The Times story is a little more allegorical, detailing the struggles of local residents as they adjust to a stronger rental market. A strengthening rental market is a good indication of a coming housing recovery, as higher rents will prompt more buyers to look to the affordability of home ownership. The largest growing segment of our clientele are investors buying homes to either hold or rehab - yet another indicator that our market is on a path toward recovery.Read more

-

Andy O’Shea & Jesse D. Moore – 5-star agents 3 years in a row!

February 1, 2011 /For the third year in a row, Jesse D. Moore and Andy O'Shea were selected by Seattle Magazine as 5-Star Real Estate Agents, Best in Overall Satisfaction. The designation is given to less than 7% of the agents in the Puget Sound market, and even fewer have won it for 3 consecutive years in a row. In addition to this, Andy and Jesse finished the year off as the #1 and #3 agents in their office of 142 agents in 2010 (Keller Williams Realty Bothell). Andy ended up as the tops agent overall, and Jesse as the top resale listing agent overall. Pickett Street Properties was the top team for the largest office in Snohomish County, closing 80 real estate transactions in 2010, and we expect to do even greater things in 2011!Read more

-

How I lost my roommates

December 12, 2010 /Trevor is my brother-in-law. I've been helping him and his wife to find their first home over the last couple of months. We made an offer on a bank-owned home in Edmonds that was accepted, but in a long and twisted tale of banking regulation gone wrong, they had to give up that home and start their search over again. They also had to move - they had given notice at their apartment complex and their unit had already been rented out. So that's how I gained two roommates :) Trevor and Liz were originally hesitant to consider properties sold at trustee's sale, but being forced to live with me encouraged them to look at all options. After watching a few properties that would normally be outside of their price range sell well within their range, Trevor and Liz threw themselves into the process. They were pre-approved to borrow funds at auction, received a username and password to search our trustee sale database, and started driving properties that they were interested in. Trevor bid on a home at auction every week for three weeks prior to Thanksgiving, barely losing out on all three. He was being conservative at my insistance…Read more

-

Buying a home at trustee’s sale in Washington State

November 9, 2010 /Remember 2006? When there were basically only two types of real estate to buy - resale or new construction? Most people, including real estate agents, hadn't even heard of short sales, and bank-owned properties made up such a small percentage of the market that finding one was a little like hunting a rainbow. It's a different time, and our team has done our best to diversify. It started by educating ourselves on the short sale process, extended into representing local and national banks on marketing their foreclosures, and in the last six months we've developing an effective system of representing buyers purchasing properties at trustee's sale in King and Snohomish Counties. What is a Trustee's Sale? Sometimes generically referred to as auction, county auction, sheriff's sale, or foreclosure auction, trustee's sales are the natural process in our state for foreclosing on a home. There are two types of foreclosures in our country, either judicial or non-judicial. Judicial foreclosures require banks to go through the court system to foreclose on a property - non-judicial foreclosures, like those in Washington State - don't go through the court system, but instead follow a set of established laws and notices that eventually lead to…Read more

-

Jesse, John & Pickett Street on National Public Radio (NPR)

October 19, 2010 /Last week I was contacted by a reporter from KPLU, the Seattle affiliate for National Public Radio, wondering if I would sit down with her and talk about how many banks have elected to temporarily suspend their foreclosure process. So last Thursday she showed up at our offices, microphone in hand, and we spent the next 90 minutes discussing this brave new world of real estate. 90 minutes of conversation with three different agents (Dennis Pearce, John McCants and myself) was edited down to 4 minutes, and a good share of that was split with Jillayne Schlicke - real estate and mortgage educator extraordinaire, and Richard Hagar - a Seattle real estate appraiser. The piece aired nationally on the "Weekend Edition" on NPR this past Sunday. I think that the initial pitch for the story was an investigative report as to how the suspension of foreclosures from big banks like Bank of America, JP Morgan Chase, and GMAC was effecting the day-to-day operation of real estate businesses like ours. As a real estate team that services short sale, bank-owned, resale, new construction, and auction properties, the suspensions most greatly affected our auction business. John is quoted in the report discussing…Read more

-

Signs of a stabilizing market? Neighborhood indicators and trends emerge…

May 11, 2010 /There was a time when real estate agents helped people buy and sell homes. Then the market changed, and now we do a lot more counseling, some financial advising, negotiating short sales with banks, and on the flip side - evaluating properties for banks as they liquidate their foreclosed assets. Regarding the latter, banks ask real estate agents to complete BPOs (broker price opinions), to give them an understanding of the local market and an evaluation of the property's value. Banks do not pay agents well for this service, but agents (including myself) do them in the hopes of listing bank-owned properties. When completing BPOs, I have enough experience that if I'm familiar with the neighborhood I have an intuitive idea what the price of the home should be before I go about the work of proving it. My intuition is not enough for the banks though, so I have to complete a fairly rigorous form that goes over statistical averages for the neighborhood of the home that I'm evaluating. I hate BPOs - but the truth is, doing them on a regular basis makes me a better agent. It's easy to take what's true for a majority of neighborhoods…Read more

-

The cost of waiting

January 13, 2010 /I just listened to a great call with an eye towards what we can expect in the year 2010 in the housing and rate market. A great point was brought up about the cost of waiting. Right now the government has pushed some major incentives into the market. In December of 2008 the government announced a purchasing program that pushed rates roughly 1% lower than where they were the previous month, and had been for almost a year. The Government is also allowing for a TRUE TAX CREDIT of $8000 for first time home buyers that is set to expire in April. These 2 things can make a huge difference for a first time home buyer. If you wait to buy and rates go up the roughly 1% that most experts are forecasting, you would be looking at a cost of about 5% of your loan amount upfront to buy down your mortgage rate back down to current levels, on a $200,000 loan that is $10,000. Add to that the loss of the tax rebate, that is nearly $20,000, or about 10% of the purchase amount. A more impressive number is the lifetime cost of a mortgage that is 1%…Read more

-

Paying the Governor’s Share: Excise Tax & Short Sales

December 23, 2009 /Here in Washington state, we are accustomed to paying an excise/state sales tax when we purchase goods. Interestingly enough, when it comes to the most significant acquisition most of us will make, the seller, rather than the purchaser, covers the taxes. Currently, the base Washington state excise tax rate is 1.28%, with each county adding on their own percentage for a total that fluctuates somewhat by area. Snohomish and King County excise taxes (in most areas) are at a .50 rate, bringing the grand total to 1.78% of the purchase price. An obvious question if you're a distressed home seller would be, "who exactly pays this tax in the event of a short sale?" In most cases, the burden falls to the bank that is carrying the mortgage to ‘eat’ that cost, along with the other costs associated with selling a home. For a brief time at the beginning of 2009, some sellers were required to pay excise tax on the amount of the shortage (the difference between what they owed, and what they were able to sell their property for in a declining market). Sellers in this category may now be eligible for a refund of excise taxes. Use…Read more

-

The anatomy of a short sale

December 17, 2009 /One of the most frustrating forms of a real estate transaction of late is the "short sale." We've had a lot of questions lately about this kind of sale, so I want to address some of the primary questions and myths. 1) A boy named Sue: There are a lot of misconceptions about short sales, starting with their name. A "short sale" is not a denotation of time - short sales actually take a long time to close. A short sale is a real estate transaction where the seller owes more for the property than the property is currently worth. In other words, the seller doesn't have any equity and in order to sell, the bank is going to have to agree to accepting less than what they're owed. For example, John Doe bought a property in 2007 for $380,000. It's now 2010, and the local real estate market has tumbled. In a "choose-your-own-adventure" twist, let's say that John (1) got divorced, (2) lost his job, (3) is transferred out of state, (4) develops a medical condition that forces a move, or (5) simply can't afford his home anymore. John's house is now worth $340,000, and since closing costs for…Read more