-

And the winner is…

January 27, 2010 /Pickett Street Properties is proud and honored to announce that all 4 of us just received the “2009 – 5 Star Realtor Award, Best in Client Satisfaction,” recently published in Seattle Magazine. This is a great honor for us - because our greatest desire is to serve our clients incredibly well. Only 758 local Realtors received this award of the over 20,000+ licensed Agents in our area. Here’s how the awards are determined: First, over 22,500 people who recently bought or sold homes were surveyed by mail and phone. Next, professionals in the mortgage and title industry were surveyed for their nominees. Stacks of surveys were received, screened and scored by Crescendo Business Services. Finally, a blue ribbon panel of local industry experts reviewed the finalists list - and the winners were announced! Those surveyed were asked to evaluate their nominees based on nine criteria: Customer service, communication, finding the right home, integrity, negotiation, marketing the home, market knowledge, closing preparation, and closing satisfaction. We want to thank our clients and those we work with for nominating us. We are thrilled with the awards, and will continue to do our best to exceed our clients’ expectations and goals. Several Agents…Read more

-

The cost of waiting

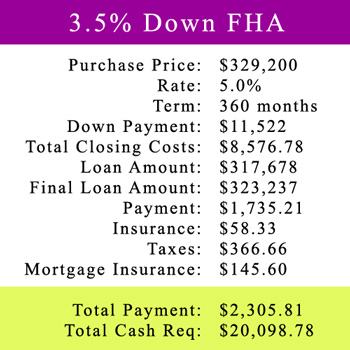

January 13, 2010 /I just listened to a great call with an eye towards what we can expect in the year 2010 in the housing and rate market. A great point was brought up about the cost of waiting. Right now the government has pushed some major incentives into the market. In December of 2008 the government announced a purchasing program that pushed rates roughly 1% lower than where they were the previous month, and had been for almost a year. The Government is also allowing for a TRUE TAX CREDIT of $8000 for first time home buyers that is set to expire in April. These 2 things can make a huge difference for a first time home buyer. If you wait to buy and rates go up the roughly 1% that most experts are forecasting, you would be looking at a cost of about 5% of your loan amount upfront to buy down your mortgage rate back down to current levels, on a $200,000 loan that is $10,000. Add to that the loss of the tax rebate, that is nearly $20,000, or about 10% of the purchase amount. A more impressive number is the lifetime cost of a mortgage that is 1%…Read more

-

The anatomy of a short sale

December 17, 2009 /One of the most frustrating forms of a real estate transaction of late is the "short sale." We've had a lot of questions lately about this kind of sale, so I want to address some of the primary questions and myths. 1) A boy named Sue: There are a lot of misconceptions about short sales, starting with their name. A "short sale" is not a denotation of time - short sales actually take a long time to close. A short sale is a real estate transaction where the seller owes more for the property than the property is currently worth. In other words, the seller doesn't have any equity and in order to sell, the bank is going to have to agree to accepting less than what they're owed. For example, John Doe bought a property in 2007 for $380,000. It's now 2010, and the local real estate market has tumbled. In a "choose-your-own-adventure" twist, let's say that John (1) got divorced, (2) lost his job, (3) is transferred out of state, (4) develops a medical condition that forces a move, or (5) simply can't afford his home anymore. John's house is now worth $340,000, and since closing costs for…Read more

-

Green Homes- Fad, Trend, or Future?

November 5, 2009 /Among the many contentious issues of our day, the concept of being 'environmentally conscious', certainly strikes a few hot buttons for some. This post isn't going to explore the politics of Al Gore, or Rush Limbaugh, because, controversial as that subject may be, there's just not enough space to do the topic justice, and frankly, I don't find it that interesting. My personal angle on the Green Movement tends to slant more toward the practicalities of implementation, and looking at the cost/benefit balance for long term value. Given the condition of our current economy, and the impact of rising energy prices, and prices overall, I don't think it's an overstatement to say everybody's looking for ways to save money. From that perspective, the question becomes one of whether it's more practical to save money now (which frequently means either making do with less, or doing nothing), or to take the preventive and holistic steps that provide for long term cost and resource savings through conservation, thoughtful design, and practical implementation of new home-building technologies. The Green Movement is really just a convenient handle for the overarching conversation that revolves around the management and distribution of resources within a given community, and attempts to…Read more

-

Yes Virginia, zero down loans do exist…

September 18, 2009 /Question: Is it still possible to get a zero down payment home loan? Answer: For the month of September, yes. (Now extended through the end of December). I received a phone call on Monday - a request from a young couple wanting to walk through a few of the floorplans available at the Summit View plat in Bothell. As we walked through the homes I asked the common questions - making sure that they were aware of the $8,000 tax credit, and it's looming expiration date. They were. I asked if they were aware of the special financing available on these brand new homes, including zero down payment and a 3.875% interest rate if they made an offer in September. They were. In fact, they were way ahead of me... She is a grad student, an unpaid intern on her way to a stable and well-paying vocation. He is self-employed, has been for five years. They have two kids in elementary school, so getting into an award-winning school district was important to them. If they would have tried to buy three years ago there wouldn't have been a problem. "Stated income" loans existed then - a now extinct type of…Read more

-

HVCC, HERA & other Bureaucratic Sausages

August 19, 2009 /The only thing that saves us from the bureaucracy is inefficiency. An efficient bureaucracy is the greatest threat to liberty." Eugene McCarthy In the spirit of an inefficient bureaucracy, and under the guise of "economic recovery", we've seen several new edicts handed down from the mountain lately. The 2 most onerous directives go by the handy handles of 'HVCC' & 'HERA'. Both attempt to right the wrongs perpetrated in this last housing runup, but from my perspective, they are relatively undisguised attempts by big banks to utilize the fear in the marketplace to have their way, creating legislation that does little to remedy the actual problems, while pushing the BIG BANKING agenda well down the road. The Home Value Code of Conduct (HVCC), enacted in April, puts severe restrictions on the lines of communication between lenders and appraisers, requiring the use of an automated online system to place appraisal orders, while keeping lenders and brokers from speaking directly, and purportedly preventing the collusion that took place in the dark ages between '04-'07. The fly in this ointment is the reality that quality work requires quality people. The new system requires lenders to draw anonymously from a predetermined pool of appraisers,…Read more

-

Housing: swimming in info, searching for the bottom

July 14, 2009 /The US Housing market officially hit bottom on Tuesday, June 16, 2009, according to Mad Money's Jim Cramer. Based on his analysis of better than expected housing starts, increasing sales, and decreasing inventory, Cramer argues that we've seen the worst of this housing debacle, and can begin the slow climb back to sanity. And yet, a month later, we're still seeing headlines that read like footnotes to the 4 horsemen's sightseeing tour. So, how can we have this extreme swing in opinion? We're all getting the same numbers, and existing on the same planet, correct? Yet I'd swear I've never seen more schizo info. There's nothing consistent, no standards of reporting, no BIG HOUSING CHART that we're all referring to- like the digital counter ticking up the national debt ( I think they ran out of slots on that one). Shouldn't there be some agency (job security!), or body of standards keepers (bureaucrats) who sift through all the info and disseminate it into neat little bite-sized, easily digestible (And Accurate) chunks so those of us with lives to lead can get our (Useful) news and still have a life? I'm sure this was the original thinking behind the current crop of infotainment/news…Read more

-

Pickett Street on the radio

June 24, 2009 /On Tuesday Dennis and I were asked to participate on a round table discussion of the real estate market on "The Money Thing," a local talk radio show that airs on Tuesdays from 12-2pm on 1150AM (KKNW). Neither of us had ever been on the radio before, but that would never keep us from offering our opinion! :) The show is hosted by Howard Bono, a mortgage originator and owner of Old West Mortgage in Everett. We had only met Howard once before, but that meeting prompted enough thought that he asked us to come on the radio program to share our ideas with his audience. The discussion was lively, and was largely in reference to the short sale processs, what we anticipated for our local market over the next 12-18 months, and how we counsel buyers in times like these. The entire program segment is available on Howard's website, TheMoneyThing.com, but I've posted just our segment below. Thanks to Howard for having us - and thanks to Jerry Jaz for taking the time to take in-studio pics.Read more

-

New home page for PickettStreet.com!

June 21, 2009 /Everybody needs a makeover from time to time, and although our website had evolved much over the past three years, the home page hadn't changed at all, and didn't accurately reflect the true scope of all the resources that we've come to provide at PickettStreet.com. Last week we unveiled a new landing page to our site that we think better reflects our team, our services, and our current real estate market. From the home page users can now go directly to a search for bank owned properties, short sale properties, and our featured new construction properties. Much like our team, our home page is now unique, resourceful, and memorable. Let us know what you think of the change in our comments! OUR NEW HOME PAGERead more

-

A loan we don’t need: HUD’s curious permissions for the $8,000 tax credit as down payment

June 4, 2009 /I've tried writing an opening sentence that explains the heart of this post, and the shortest I could make it was more than 50 words, which is hella long. So let me try another tact. The American Recovery and Reinvestment Act of 2009 allows residents (first-time homebuyers) the purchase a home before December 1st a tax-credit of $8,000. The Washington State Legislature recently approved a measure that allowed eligible residents to use the promise of this credit to secure a loan from the state government so that those funds could be used on the down-payment of home, thus enabling people that have not saved the minimum 3.5% down the opportunity to (1) become a homeowner and (2) take advantage of the $8,000 tax credit while it's available. Said measure sat in political purgatory as it seemed that the legislature (and other state legislatures that had approved the measure) may have overstepped their bounds - so the Department of Housing and Urban Development (HUD) has been meeting to decide if they were going to allow homebuyers that hadn't saved the minimum down payment requirement to use state funds as a short-term loan for the down payment. So the HUD has ruled:…Read more

-

Maybe the sky isn’t falling.

May 11, 2009 /Maybe the “sky” isn’t falling?! A chicken and a pig walk into a grocery store…………..Nah, I’ll save that story for another time. : ) I get asked at least once every day, often multiple times: “Andy, how are things going in real estate, REALLY?! Is it as bad as it sounds?" Truthfully, in my opinion: No! I’m seeing offers being written on homes - almost every day. I’m meeting with sellers who realize 2007 prices are gone - but that they can still sell their home, and do. I’m helping investors find incredible values - on all types of properties. I’m marketing new construction homes for Builders - and receiving offers every weekend. I’m working with Banks to offer 3.75% interest rates to First Time Home Buyers – who are loving it! Yeah, I’d say things are “looking up”. Did you read the article in last week’s Seattle Times entitled: “Pending sales of single-family homes in King County surged in April”? The article mentions some of the good news: King County Pending sales were up 25% in April over March. Snohomish County Pending sales were up 28% in April over March. One factor to keep in mind, though, is that…Read more

-

Building Green- Was Kermit Wrong?

April 17, 2009 /With all the talk since January of inventive incentives to seemingly stimulate everything from hair growth to employment, never mind the pin-striped panhandlers on Wall Street (don't even get me started!), it's been interesting to watch the recent evolution of the environmental movement. From a tree-dwelling band of radical long-hairs with an agenda but little else, the cause has grown to encompass nearly every segment of our consumer-centric society. To paraphrase Chickenman, "It's Everywhere!" From Dr. Bronner's soaps (one of the true originals) to the Toyota Prius, there's been a sea change in perceptions of the impact our daily activities have on the planet. Few consumer products have escaped the scrutiny and benefit of an eco-makeover, with some being truly re-made, while others have received the marketing equivalent of a botox injection- also known as 'Green-washing'. Being green was once a tough sell due to the perception that it was 'difficult', and expensive. As green products and processes have slipped into the mainstream, that position has gradually become harder to defend; especially as the businesses who once protested have come to realize the economic benefits of waste prevention, thoughtful materials utilization, and positive PR. Green has become a critical component…Read more