-

The Pros and Cons of a Pre-Inspection

May 20, 2016 /These days, Seattle’s real estate market is on a hot streak. A low inventory combined with a robust and growing job market is driving the region’s demand for real estate sky-high. With an outlook like this, it’s a phenomenal time to be a seller, but, if you’re a buyer, it’s easy to be tempted to rush through a sale and squeeze in an offer immediately. Of course the market demand necessitates a certain level of swiftness, but it’s worth considering the pros and cons of a pre-inspection to ensure you’re getting the right house for the right price. What is a pre-inspection? A pre-inspection is exactly what it sounds like: an inspection undertaken prior to making an offer that aims to uncover any potential defects. The process has the same scope of a standard home inspection, and buyers who move forward with a pre-inspection can choose to waive the inspection contingency, a negotiated agreement allowing the buyer to inspect the home shortly after closing a deal. Pros Obviously, the main benefit of completing a pre-inspection is that it uncovers any potential problems. In a worst-case scenario, you might discover a hidden catastrophe and avoid buying a house with significant defects.…Read more

-

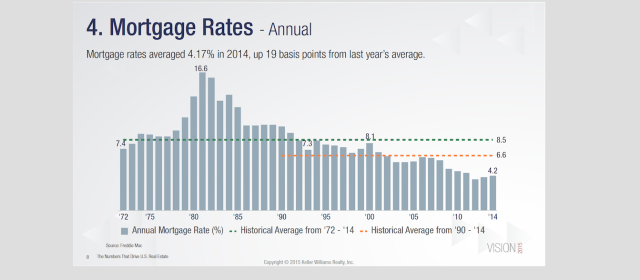

Did you know that in the 80’s the mortgage rate was 16.6% at one time?

May 4, 2016 /On Wednesday, the Fed voted to maintain the current rate of interest but did signify the possibility of rate hikes later in the year. As such, the federal funds rate will remain in the current range of 0.25-0.5%. In its press release, the Fed indicated a sense of optimism in regards to the presence of improvement in both household incomes and the labor market. Additionally, the Fed noted the housing sector has continued to improve since the beginning of 2016. However, inflation is still below the Fed’s ideal rate of 2%, while consumer spending, investment in the business sector, and net exports are not as strong as they could be. The Fed’s overall consensus is that, while the economy is still showing steady signs of improvement, there are still a few obstacles in the way. As such, the Fed has chosen to keep the federal funds rate unchanged for the time being. The Fed’s next meeting will take place in June, and there is a possibility that we’ll be seeing rate increases by July. At any rate, the Fed hopes to authorize about two rate hikes during the remainder of 2016. How Does This Affect Mortgage Rates? Contrary to a…Read more

-

Top 3 Reasons You Shouldn’t Sell “For Sale By Owner”!

April 22, 2016 /Often, society encourages us to cut the “middleman” out of our numerous daily transactions. In some situations this plan makes sense, as it tends to make things more efficient. However, in the context of a real estate transaction, cutting out the middleman (aka, your real estate agent) could be downright disastrous. If you’re selling your home, you might be tempted to save money by attempting a For Sale By Owner (FSBO) transaction. A FSBO is a sale conducted solely by the owner of the home, and so he or she circumnavigates the commission fee and cost of hiring an agent. While this idea might seem attractive on paper (“No commission fee? Sounds great! What could possibly go wrong?”), it’s important to understand that, in most cases, a FSBO means big losses for the seller in more ways than one. Read on for an explanation detailing why every homeowner selling a house needs a real estate agent. Agents Are Professionals While sellers are obviously driven to sell their homes, this motivation does not make most of them experts in the varied minutia hidden in a real estate transaction. A real estate agent, however, is an expert, and this expertise is vital…Read more

-

Don’t Pay Off Your Mortgage!

February 26, 2016 /At least, don’t pay it off quite yet. If you’re an average, hard-working adult with a family and a home to call your own, then chances are you’re probably trying to pay off your mortgage as quickly as possible. This strategy seems pretty sound at first; after all, won’t you save money in the long run by paying off your mortgage ASAP? Surprisingly, in many cases paying off your mortgage quickly won’t save you money at all; indeed, rushing through a mortgage could actually be costing you money in the long run. While you’ll want to pay your mortgage off eventually, it is generally more beneficial to take your time and invest your hard-earned money in other ventures. If this idea seems counterintuitive to you, never fear! Below, you’ll find a few of the main arguments for taking your mortgage payments nice and slow. Your mortgage's interest is tax-deductible. While many people regard paying interest with dread, remember that paying interest on a mortgage will actually reduce the amount of money you need to pay for taxes each year. For instance, say you’re in the 35% tax bracket. Since your interest payments on your mortgage are tax deductible, you’re actually saving…Read more

-

Real Estate Trends to Watch for in 2016

January 26, 2016 /Usually, I’m surprised to look at my calendar each January and find that suddenly, and apparently without my permission, time has continued to roll forward. However, this year I am determined to think more about the year ahead, rather than dwelling on what’s already behind me. As such, now is a perfect time to consider some key real estate trends, and especially some important mortgage trends, to look out for in 2016. Whether you’re preparing to buy your first home, or you’re on the cusp of selling a reliable and beloved property, you’ll want to check out the exciting forecasts below. Buying is Better than Renting First, let’s talk finances: if you’re a renter, then you’re in for some bad news, because rents are currently becoming more expensive and less affordable. In fact, according to The National Real Estate Post, rents are rising at about 4 percent per year. As such, it’s hardly surprising that more and more renters are having trouble finding rates that don’t exceed the recommended 30 percent of their monthly budget. Conversely, buying a home is more affordable. While mortgage rates may have risen slightly, expect them to remain relatively low. Many experts forecast four…Read more

-

A Message From Our Mortgage Partner: Cody Touchette!

December 18, 2015 /The Fed, Mortgage Rates, and Rent The Fed has recently raised interest rates from a range of 0% - .25% to a range of .25% - .5%. Predictably, this decision has lead many to wonder whether higher rates will mean a slowdown of the generally recovered housing market. The fact that buyers have recently recovered their confidence after slogging through the recession makes answering this question particularly important. Luckily, it’s unlikely that the Fed’s decision to raise interest rates will significantly slow the housing market’s recovery. Indeed, according to a recent NPR article, most of the nation’s homebuilders do not believe that the housing market’s recovery is going to slow following the Fed’s decision to raise interest rates. The primary reason for this opinion is that the raise in rates has been modest and will take place gradually. Additionally, mortgage rates have already been slowly inching upwards in anticipation of the Fed’s decision, further softening the impact of the increase. Finally, it’s unlikely that dramatic spikes in interest rates will be occurring any time soon. As of now, interest rates are expected raise about one percent over the next several years. Additionally, it’s important to realize that, as of now,…Read more

-

LE vs. GFE and CD vs. HUD-1

October 30, 2015 /This month has seen a significant change to the way mortgages are finalized. The GFE, initial TIL, and HUD-1 and final TIL forms are gone for good and, as of October 3rd, the LE (Loan Estimate) and CD (Closing Disclosure), replaced them. If you’re an average consumer, you’re probably wondering two things: What do these new forms mean? How does this change affect me? Luckily, both questions are relatively easy to answer. Below, you’ll find the basic information about what the new laws mean and how they’ll affect anyone applying for a mortgage in the future. LE and CD: the Basics Historically, lenders have been legally required to provide consumers applying for mortgage loans with two documents, the TIL and GFE, and then two more documents, another TIL and the HUD-1, shortly before finalizing a mortgage loan agreement. All of these documents communicated repetitive information using irregular language, thus sacrificing an unnecessary amount of trees to provide you with much of the same information twice. This process, as you can imagine, was a complicated one for average Americans. To streamline the process, federal law has mandated that the GFE, initial TIL, and HUD-1 and final TIL forms be replaced by two basic forms, the LE and the CD. Anyone applying…Read more

-

The Fed and Mortgage Rates

September 25, 2015 /If you’ve been keeping up with recent economic events, you’re probably aware that the Fed has chosen to keep interest rates stable, rather than moving forward with the raise that many experts anticipated. While the American dollar has strengthened, and while unemployment rates have improved more quickly than originally expected (it currently sits at a lean 5.1%), the Fed still decided to take a cautious approach. The Fed has cited a few factors, most notably a weak global market, for its decreased confidence in predictions for inflation. The Fed considers the global economy to be weak for a couple of reasons. The prices of commodities have decreased, and a relatively robust American economy has lowered the price of imported goods. Additionally, while the domestic economy shows encouraging signs of continued improvement, there are still a few worrying trends; many employed citizens, for instance, only work part-time and are still searching for more lucrative, full-time employment. Additionally, the rate of inflation still lies below the Fed’s desired 2%, the ideal rate of inflation for a healthy economy. In the face of a less than ideal global economy, the job market is going to need to strengthen, and the inflation rate must…Read more

-

Picking a Mortgage Lender!

September 21, 2015 /For many people, the hardest part about finding a mortgage lender is simply knowing where to start. There are a lot of lenders out there — some small and local, and some large and national — so you shouldn’t feel discouraged if you’re having difficulty getting your search started. This post will aim to make the process of picking a mortgage lender easier by offering some basic advice. We'll also provide contact information for Pickett Street's recommended lender, Cody Touchette (MLO 83216), giving you a quick connection to an expert committed to providing outstanding service. In addition to looking over our guide to picking a mortgage lender, check out Cody's website for more information: The Touchette Team. Where to Start One way to start narrowing down your options is fairly simple: ask friends and family. More specifically, ask your friends and family who own homes for recommendations. If you have a friend who just bought a house and is absolutely thrilled, ask her who she worked with and how she worked with her lender to ensure she got the best deal possible. If you’ve got a cousin who’s been an unsatisfied homeowner for several years, ask him who he worked with and…Read more

-

Paying the Governor’s Share: Excise Tax & Short Sales

December 23, 2009 /Here in Washington state, we are accustomed to paying an excise/state sales tax when we purchase goods. Interestingly enough, when it comes to the most significant acquisition most of us will make, the seller, rather than the purchaser, covers the taxes. Currently, the base Washington state excise tax rate is 1.28%, with each county adding on their own percentage for a total that fluctuates somewhat by area. Snohomish and King County excise taxes (in most areas) are at a .50 rate, bringing the grand total to 1.78% of the purchase price. An obvious question if you're a distressed home seller would be, "who exactly pays this tax in the event of a short sale?" In most cases, the burden falls to the bank that is carrying the mortgage to ‘eat’ that cost, along with the other costs associated with selling a home. For a brief time at the beginning of 2009, some sellers were required to pay excise tax on the amount of the shortage (the difference between what they owed, and what they were able to sell their property for in a declining market). Sellers in this category may now be eligible for a refund of excise taxes. Use…Read more