-

Washington State shorts sellers: an obvious problem with short sales, excise tax & Washington State’s position

January 11, 2009 /UPDATE: If you're looking for information on the short sale process in regards to real estate transactions in Washington State, you might want to read "The Anatomy of a Short Sale" instead. The post below is a response to a policy from the Washington State Department of Revenue on short sales that has since changed. To tell this story effectively, I'm going to have to explain a few things - assuming that not all of you are up on the real estate vernacular of the day. Excise tax: In the sale of real estate, Washington State charges a tax in the amount of 1.78% of the home's value (to be paid by the seller). One would think that the easiest way to determine value on a property that recently sold would be to...I don't know...maybe...look at the sales price?!?! But we'll get to that in a minute. Short sale:I would think that most of you would be familiar with this term, but in talking with friends and clients, I think that many are unclear of its true meaning. A "short sale" is different from a foreclosure or pre-foreclosure sale, in that the seller may be absolutely current on all of their…Read more

-

Reverse Mortgage Psychology

December 17, 2008 /Remember when interest rates were bouncing around the 6-7% mark, and homes were flying off the shelves? And remember how buyers in that wild market would forgo inspections, write offers on the hoods of their cars, and painstakingly draft impassioned letters of introduction to sellers, pleading for clemency in the life-sentence of homelessness the market was imposing on them? We've all watched the steady deflation of the confidence that accompanied those times, to be replaced by the looming grey cloud of indecision and angst. However, the reality is that rates have fluctuated less than 3 points in the past 8 years (2000-2007)- all the way back as far as 2000, when we reached a high that year of 8.52%, right around the time the DotBombs were imploding, and the country was talking recession. The lowest we've seen since then was June of 2003, when rates briefly bottomed at 5.23%. Throughout the next 4 years, the lowest point was a short stop at 5.45% in March of 2004. The remainder of that timespan was spent hovering between the high 5's, to the high 6's. On the surface of it, there are a few obvious reasons for the mental shift; the subprime collapse, Wall Street's subsequent malaise, an…Read more

-

Forbes ♥ Seattle real estate market: Quick to Rebound

November 6, 2008 /You have to love good news about our real estate market - and if it happens to come from one of the premier authorities on wealth, well that doesn't hurt. Forbes recently published an article declaring Seattle's real estate market as the most likely to rebound. I'm posting the beginning of the article here, with a link to the full story below: If you're a homeowner seeing property values plummet, look to the commercial real estate market for solace. It might tell you which areas will recover fastest--and which will likely remain weak. The Urban Land Institute recently asked 700 real estate professionals to name the best (and worst) places to invest in commercial real estate in the coming year. Those surveyed included private developers, Realtors and Real Estate Investment Trust executives. Their answers also apply to the residential market, since the single-family-home sector typically follows the economy. As wages go up and there are more jobs, more people can buy homes, pushing prices up. The best cities in which to invest are those that are considered gateways to international investment, have vital downtowns where people can forgo cars, and don't have a glut of condos or office space. These traits…Read more

-

When bad news is good news for the housing market

September 21, 2008 /I attended an annual private function on Camano Island yesterday, where I soaked up the rain with an extended family of clients and friends. As is the case with almost anything I attend lately, most of the questions I fielded were about the local housing market. One client was looking for a part-time assistant, and mentioned that a majority of applicants were real estate agents who needed a steady paycheck. A cousin of one of my friends asked me about foreclosures and short sale opportunities. But overwhelmingly, most were curious when I thought this current slump might be over. In the face of a volatile week in the stock market, and with the government bailout of Lehman Brothers and AIG, I stunned almost all of them when I said that all of the bad news is an indication of forthcoming stability in the real estate market. If things are going to get worse before they get better (as so many pundits like to say), then I say let's look for the worst and we'll see markers for coming improvements. Here are a few indications why I think we may be seeing the worst: Foreclosures Rise Locally Excuse me while I put on my rose-colored…Read more

-

The Silver Lining

September 17, 2008 /Every job has its challenges. In the last few weeks, for many, remaining employed is becoming a primary challenge. That, of course, is one of the many reasons I pursued self-employment; I may not have control of many external things, but at least I'm in good with the boss, and I know what I've got to do to keep food on the table. Another of my key reasons for being a Realtor is the knowledge that I am in a position to help good people who are frequently making decisions that will have a huge impact on the futures of themselves and their families. It's a weighty responsibility that I take very seriously, and that incurs some sleepless nights, frequently long hours, and a challenging schedule, but the satisfaction that I get from being a part of their lives at this vital juncture keeps me striving to be at the top of my game. A prime example of this is the young couple I'm currently working with on their first home purchase. I'm going to call them Ted and Jennifer, for the sake of privacy. Ted is a graduate of West Point and has spent the last 9 years in…Read more

-

Stop Making Sense

September 10, 2008 /Regardless of whether your glass tends toward half empty, or half full, the last week has provided plenty to talk about. Starting with the announcement Sunday that Treasury Secretary Hank Paulson was busy cleaning house at the 2 GSE's, and then Monday's market rally, along with the dramatic 1/2 point mortgage rate drop, it was one for the history books, as they say. And this all follows a bold prediction by CNBC's Jim Cramer, of Mad Money fame, stating unequivocally that the third quarter of 2009 will see the housing bottom. Whew- Now that's a lotta meatballs! Whatever your perspective, there's more than enough to chew on for a while. So, while you're digesting, I'm going to review where we are: Rates have dipped to the mid 5% range, as a direct result of news that Fannie and Freddie are now property of the taxpayers, stocks jumped over 300 points as Wall Street's Monday juices got flowing, and we've had a prediction from one talking head that housing will reach its nadir in a year. And no, I didn't make any of this up. What does it mean? If I knew the answer to that.... My short answer goes like…Read more

-

Designed to Sell

August 13, 2008 /If you’re planning to sell, you better sit down in front of your TV. I’ve been selling real estate for over 8 years now, and I have encountered many different, shall we say, less than appealing homes. I have had sellers tell me “Oh, I’ll just give the buyer a carpet allowance, they probably won’t like the color I pick anyway.” That same reasoning has also applied to the removal of paint colors that are very specific to the seller’s taste. There are also the awkward conversations about pet odors, kitchen odors or lingering cigarette smoke. Naturally, when you live in a home, you get used to how things are. You probably have a few projects that “you’ll get to” later- also known as 'Round-to-it's'. Those little coffee spots on the carpet add “character”. The huge display case of a collection that has been growing for the last decade is a source of pride and the hallway of family photos makes you feel warm and fuzzy. Ahhh, if only a buyer felt the same way about things. Unfortunately, the buyer may not appreciate the lilac wall with the purple sponge painting technique. The wall of mirrors with the gold mottling…Read more

-

Cramer vs. Cramer

July 31, 2008 /Every once in a while (about twice a day, or so) someone asks for my thoughts on the current housing market. I'm in the industry, I read everything I can get my hands on, and those who know me generally consider that I'll give them the straight scoop, to the best of my abilities. It's that little caveat 'to the best of my abilities' that keeps me up at night. I was reminded of this conundrum last week, as I happened to catch a snippet of 'Mad Money', the CNBC financial show hosted by loudmouth Wall Street pundit and market observer, Jim Cramer. As he blathered about WAMU, Wachovia, the general financial picture, and whom to buy, hold, and sell, it became apparent once again that even his views are in a constant state of flux. As we all have seen, the economy is an unfolding story- one that even a guy like Cramer, with all his access to the inside can't keep up with. However, Cramer's on the same page with guys like Warren Buffet's housing expert, Ronald J. Peltier, when he said in last week's show, "Buy a home in the next 6 months!" This is the bookend…Read more

-

Summer Secrets

July 23, 2008 /We all know the old saying, "All work and no play... " in which Jack becomes a dull boy for keeping his nose to the grindstone. Well, Jack and I have had too much in common lately, and it has prompted me to reminisce on summers past, when I've had the luxury of exploring some of our areas scenic escapes. As I've spent a little time reviewing, I've realized with some surprise, that I've amassed a pretty fair travelogue, and since I'm not likely to get back to many of them any time soon, the decent thing to do would be to spread the wealth to those enterprising folks with a little more time on their hands. Most of my favorite trips have involved a few days in the woods with a backpack, and a flyrod, so that's going to be the slant of this post. The majority of my travels have been in the North and Central Cascades- starting in college with short weekend trips around the Bellingham area to Pine & Cedar Lakes- small, twin lakes packed with brown and rainbow trout, and populated by clouds of voracious mosquitoes. The hike in is, while not overly long at…Read more

-

Puget Sound ranks among the best in recent study

July 8, 2008 /Recently, Dennis wrote a blog post about seeing the long range picture when considering purchasing. As fate would have it, I have stumbled upon more information to support that fact AND I think buying prior to September might be a good idea. Read on: PMI Mortgage Insurance Co., the primary U.S. subsidiary of The PMI Group, Inc. (NYSE: PMI), today released its Summer 2008 U.S. Market Risk Index(SM), which ranks the nation's 50 largest metropolitan statistical areas (MSAs) according to the likelihood that home prices will be lower in two years. To put it simply, the higher the score, the greater the chance that home prices will decline in the next 2 years. Here’s an example where bigger is NOT better. For instance, the number one position is held by Riverside-San Bernardino-Ontario, CA with a 95.5% chance prices will be lower. That is amazing to me and I feel sorry for the sellers that are attempting to sell in that area. Most buyers would be extremely leery of investing their money in a home that has a less than 5% chance of being worth what they paid for it in 2 years. "Compared with a year earlier, there has been…Read more

-

How over-pricing a home costs sellers money

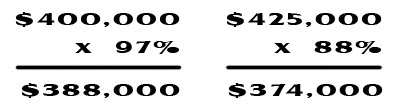

February 19, 2008 /Pricing a home for market: it very well might be the single most important element of a successful home sale, and probably the very reason most sellers should think twice before attempting to sell their home themselves. I say this as a Realtor and a home owner. No one knows better than myself the sweat and coin that I poured into my home, which my wife and I bought as a foreclosure. We had to rehab the septic system, replace the windows (all 15 of them), hang cellular blinds throughout, replace the attic insulation, sheet and replace the roof, update the kitchen, paint the exterior...well, you get the idea. Knowinig how much time and expense we put into our home, and staying aware of the neghborhood values and the lack of updates in many of those homes, it's easy for me as a home owner to assume that our home would warrant at least 6-8% more than the market average. As a Realtor, my experience tells me that I'm not objective, and my lack of objectivity might cost me money in the long run. What do I mean? Citing a collegiate study of the real estate market in California, an…Read more

-

Propaganda P-I

November 27, 2007 /Yes - as in the "Seattle Post-Intelligencer." Take this article for instance: Seattle's 12-month reign atop the nation in annual home-value increases came to an end in September, according to a report released Tuesday. Charlotte, N.C., posted a year-over-year increase of 4.72 percent, just ahead of Seattle's 4.69 percent, according to Standard and Poor's S&P/Case-Shiller Home Price Indices. To the informed mind, this might sound like good news: despite a falling American dollar, despite the collapse of the sub-prime mortgage market, despite national news reporting falling home prices across the nation, home values in our area continue to rise! Not at the meteoric rate that we had seen over the past four years - but who really wanted/expected that to continue? Instead, the data shows that homes in Seattle appreciated only 4.69%, a small-to-moderate gain among a nation of markets with falling values (a home purchased at $400,000 a year ago with annual appreciation of 4.69% would now be worth $418,760). Back to the article: Just five of the 20 cities the indices track posted year-over-year increases, while all 20 declined from August to September. The 20-city composite dropped by 4.9 percent from the prior year and 0.9 percent from…Read more